Our News

Stay up to date on the latest news concerning shipping, public holiday notices and other updates

Our high standard of personal customer care, supported by years of expertise dating back to 1994, means that you can safely count on us every step of your freight’s journey.

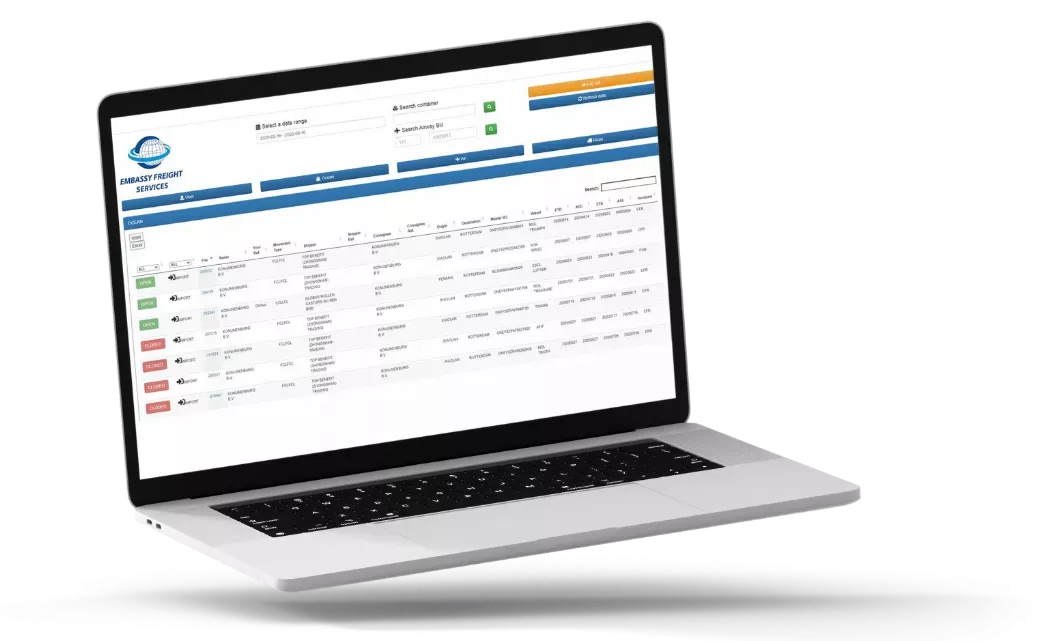

We constantly keep a sharp eye on your shipment, with our digital track & trace system. We handle your EDI, XML and API needs with seamless data integration and develop customised reports to provide all the information you need.

Stay up to date on the latest news concerning shipping, public holiday notices and other updates

Our team is making their final preparations to depart to Dubai. We hope to meet you at WCAworldwide Conference on 27th Feb-2nd March.

Phase 1 of the Carbon Border Adjustment Mechanism is coming!

At Embassy Freight, we know how important it is to track your cargo closely. That’s why we developed our digital Track & Trace tool. Simply log on to track a current shipment, view all details and download relevant documents.

No access yet? Our team will gladly help you out.

Follow us on LinkedIn.